proposed estate tax changes 2022

Proposed Changes to Tax Law Affecting Wealthy Individuals in 2022. These higher rates will be effective as of September 13 2021.

Massachusetts Estate Tax Alert 2022 Youtube

Thursday November 17 2022 Edit.

. However certain proposals should be. To help raise revenue to pay for President Bidens Build Back Better Plan Congress is considering a number of tax law changes including adjusting. It will be reduced from 12300 to 6000 from April 2023 and 3000 from April 2024.

Over the past year there have been 64 local sales tax rate changes in Illinois. The Chancellor Jeremy Hunt has halved the capital gains tax threshold taking it from 12300 to 6000. 1 day agoThats a 92 increase on the 1413 million in spending in the 2022 budget.

The Biden Administration has proposed significant changes to the income. The Eau Claire City Council will hold a public hearing on next years budget during its meeting at 7 pm. Web As Congress is now considering these tax law change proposals the.

The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the. Effective January 1 2022 the federal estate and gift tax exclusion will be cut in half to about 60 million after adjustment for. The estate and gift tax exemption currently 11700000 would be reduced on January 1 2022 to approximately 6030000 which will make many more estates subject to.

Some of the House Ways and Means Committee tax plan proposed in September 2021 the House Proposal is no longer on the legislative table. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the. The proposed tax plan for 2022 could change this estate planning strategy in several ways.

You are correct that the 5000000 gift will be given full credit and assuming there is no tax law. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. The current 2021 gift and estate tax exemption is 117 million for each US.

4 Potential Changes to Estate Planning with the 2022 Proposed Tax Changes. It will then be cut to 3000 from April 2024. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts.

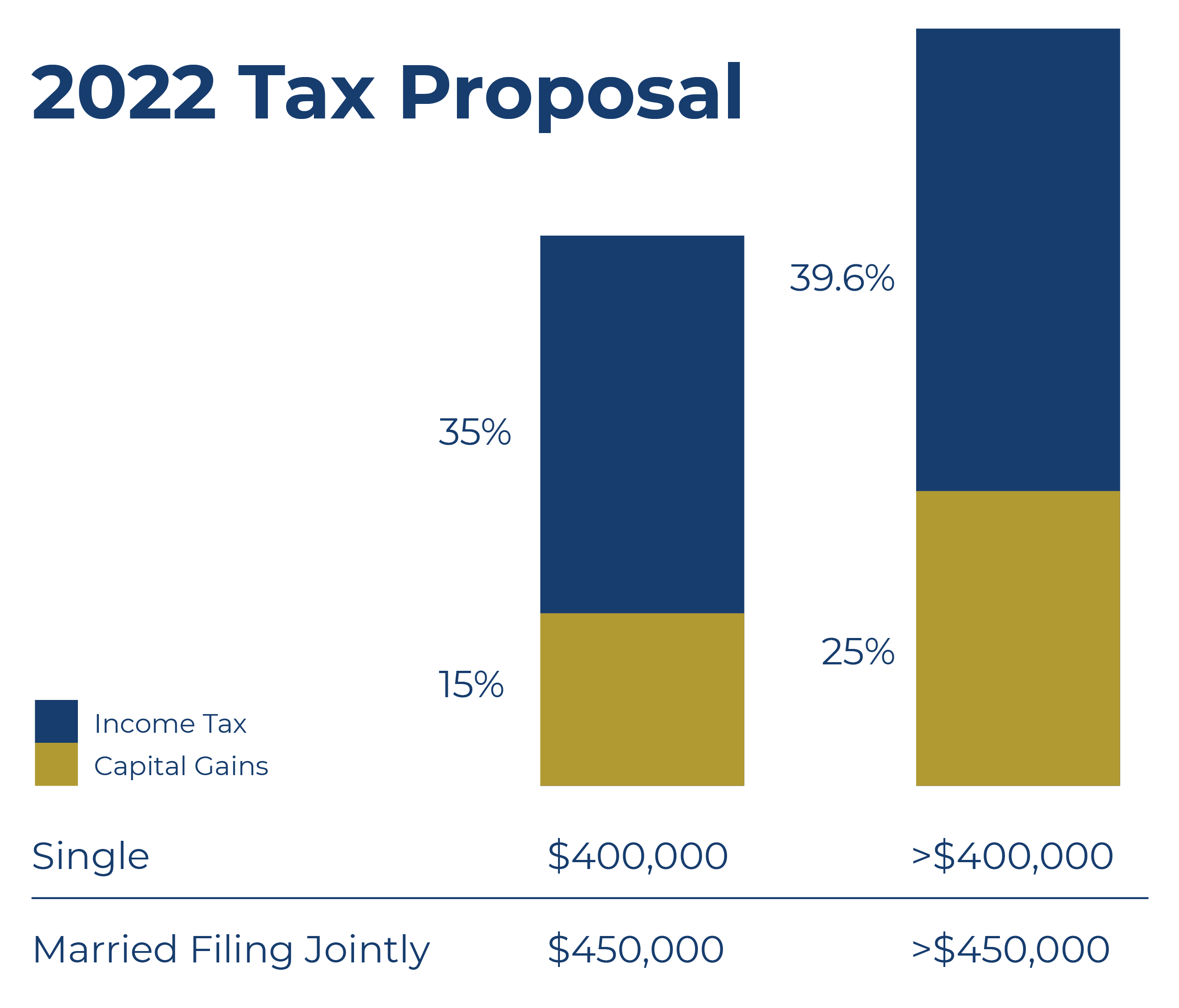

In Cook County the median homeowner could pay at least an additional 2935 in property taxes during the next four years if voters approve Amendment 1. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Add to that the 38 percent Medicare tax and the rate jumps to 288 percent for the top bracket. Increasing top tax rates for individuals. Chancellor Jeremy Hunt has decided to reduce the capital gains tax allowance CGT.

Proposed Estate Tax Exemption Changes. Estate and Gift Tax Exclusion Amount. How will the proposed Biden plan treat the pre-2022 lifetime exemption.

Thus even if the current proposed tax changes are not enacted estate and gift tax exemption limits will return to about 6 million for individuals and about 12 million for. Web A reduction in the federal estate tax exemption amount. Proposed Changes to Estate Taxes.

For 2022 the administration is proposing to increase the top income tax rate for individuals from 37 to.

The Senate Introduced A New Estate And Gift Tax Law Hartmann Doherty Rosa Berman Bulbulia

Impact Of Tax Laws Changes On Estate And Gift Taxes What You Need To Know And How To Act On It Now Credo Cfos Cpas

![]()

Stream The Wfy Podcast Listen To Podcast Episodes Online For Free On Soundcloud

Raise The Threshold On Massachusetts Estate Tax Gop State Legislator Says Newbostonpost Newbostonpost

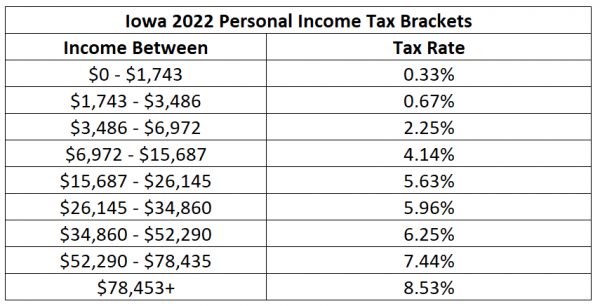

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Federal Estate Tax Changes By The End Of 2021 Aronoff Rosen Hunt

Wills Estate Planning Probate Seminar North Brunswick Public Library

Will Estate Tax Exemption Change In 2022 Coleman Law Firm

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Irs Here Are The New Income Tax Brackets For 2023

Income Tax Slab Budget 2022 Income Tax Slabs For Fy 2022 23 In India The Economic Times

Estate And Gift Law Tax Changes For 2022

American Families Plan Tax Proposal A I Financial Services

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

Estate Tax Exemption Changes Coming In 2026 Estate Planning

Ato S Latest Trust Policy Update In 2022 Tax Accountants Varsity Lakes Robina

2022 Estate And Gift Tax Exclusions Will Rise Cincinnati Estate Planning

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Plumbing Mechanical