nc estimated tax payment calculator

Calculate how much youll pay in property taxes on your home given your location and assessed home value. 7 Mail the completed estimated income tax form NC-40 with your.

The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

.jpg)

. After a few seconds you will be provided with a full breakdown of the tax you are paying. North Carolina Department of Revenue. This mortgage calculator will help you estimate the costs of your mortgage loan.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Contact your county tax. Youll need to make the payments four times per year according to these due dates.

Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user. Form CD-429 Corporate Estimated Income Tax is used to pay corporate estimated income tax. Your county vehicle property tax due may be higher or lower depending on other factors.

File Pay Taxes Forms Taxes Forms. Calculate net income after taxes. This calculator is intended for use by US.

The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive income tax system with rates ranging from 6 to 775. The personal income tax rate will drop from the current 525 to 499 next year and will continue to decline gradually over the next few years until reaching 399 in 2026 and -of the. The tax rate cuts will disproportionately help the richest earners.

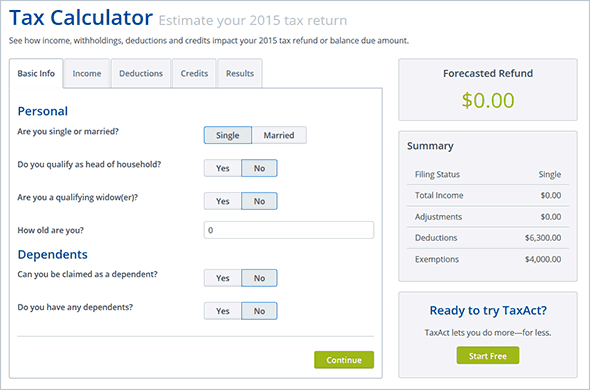

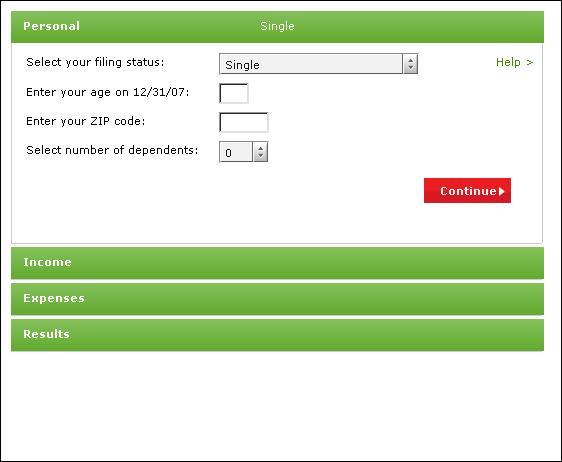

Please enter the following information to view an estimated property tax. Enter Your Information Below Then Click on Create Form to Create the Personalized Form NC-40 Individual Estimated Income Tax. North Carolina Estate Tax.

North Carolina Department of Revenue. Taxable income 87450 Effective tax rate 150. The calculator should not be used to determine your actual tax bill.

To make the easy calculation for lump-sum lottery taxes state-wise in the USA and country-wise for the rest of the world. You can also pay your estimated tax online. Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user.

Enter Your Status Income Deductions and Credits and Estimate Your Total. PO Box 25000 Raleigh NC 27640-0640. There is a variation on lottery tax on winnings according to country policy for lottery winners.

North Carolinas statewide gas tax is 3610 cents per gallon for both regular and diesel. This calculator is designed to estimate the county vehicle property tax for your vehicle. Calculate net income after taxes.

April 15th payment 1 June 15th payment 2 September 15th payment 3. Individual Income Tax Sales and Use Tax Withholding Tax. But a different change that lawmakers have also passed to increase the standard deduction.

PO Box 25000 Raleigh NC 27640-0640. Overview of North Carolina Taxes. It can also be used to help fill steps 3 and 4 of a W-4 form.

Pay individual estimated income tax. Once youve used our estimated tax calculator to figure out how much you owe making the payment is fairly straightforward and takes less than 15 minutes. Link is external To pay individual estimated income tax.

Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Failure to pay the required amount of estimated income tax will subject the corporation to interest on the underpayment. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

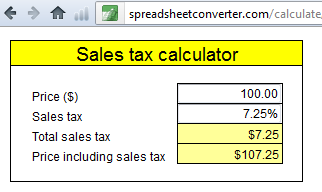

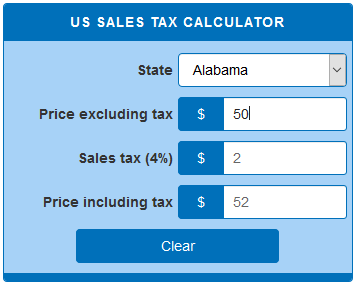

Factors in Your North Carolina Mortgage Payment. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Carolina local counties cities and special taxation districts. It is warning me of possible penalty for next year if my withholding is.

How To Calculate Payroll Taxes Methods Examples More Created with Highcharts 607. The estimated tax you will pay. In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. This North Carolina hourly paycheck calculator is perfect for those who are paid on an hourly basis. Click here for help if the form does not appear after you click create form.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. In North Carolina you can expect to pay roughly 077 of your home value. This is the 17th-lowest state effective tax rate in the nation.

Home File Pay Taxes Forms Taxes Forms. Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download. Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules.

Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax. Nc estimated tax payment calculator. North Carolina repealed its estate tax in 2013.

In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return. Compare your rate to the North Carolina and US.

North Carolinas property tax rates are relatively low in comparison to those of other states. Switch to North Carolina salary calculator. 2022 NC-40 Individual Estimated Income Tax.

To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Make one payment or. For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and.

Income Tax Calculator Estimate Your Refund In Seconds For Free. Payments of tax are due to be filed on or before the 15th day of the 4th 6th 9th and 12th months of the taxable year. North Carolina Gas Tax.

Individual Income Tax Sales and Use Tax Withholding Tax. Get a clear breakdown of your potential mortgage payments with. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Schedule payments up to 60 days in advance. The average effective property tax rate in. I live in VA and work in NC In performing my tax review the software flagged my estimated tax payments bc I checked 1a and 3a on the estimated tax worksheet.

Use the Create Form button located below to generate the printable form. Find your total tax as a percentage of your taxable income. Property taxes are one of the first things to consider as an added cost to homeownership.

With Tax Calculator Online 52 Off Www Norfarchtrust Org Uk

How Much Should I Set Aside For Taxes 1099

With Tax Calculator Online 52 Off Www Norfarchtrust Org Uk

With Tax Calculator Online 52 Off Www Norfarchtrust Org Uk

With Tax Calculator Online 52 Off Www Norfarchtrust Org Uk

With Tax Calculator Online 52 Off Www Norfarchtrust Org Uk

Self Employed Tax Calculator Business Tax Self Employment Employment

Mortgage Calculator Mortgage Calculator Mortgage Amortization Schedule

Mortgage Calculator Mortage Calculator Mortgage Comparison Mortgage Payoff

Quarterly Tax Calculator Calculate Estimated Taxes

Express990forms Express990forms Twitter In 2021 Solutions

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Quarterly Tax Calculator Calculate Estimated Taxes

With Tax Calculator Online 52 Off Www Norfarchtrust Org Uk

Qualified Nc Child Support Calculator Worksheet B Ncchildabduction Ncchildadoption Ncchi Personal Financial Statement Financial Statement Statement Template

It S Tax Season Use Your Refund To Jump Start Your Down Payment Savings Tax Season Tax Refund Down Payment

Selling Property In India Here Are Some Reminders Property Lawyers In India Legal Services Property Valuation Consulting Business